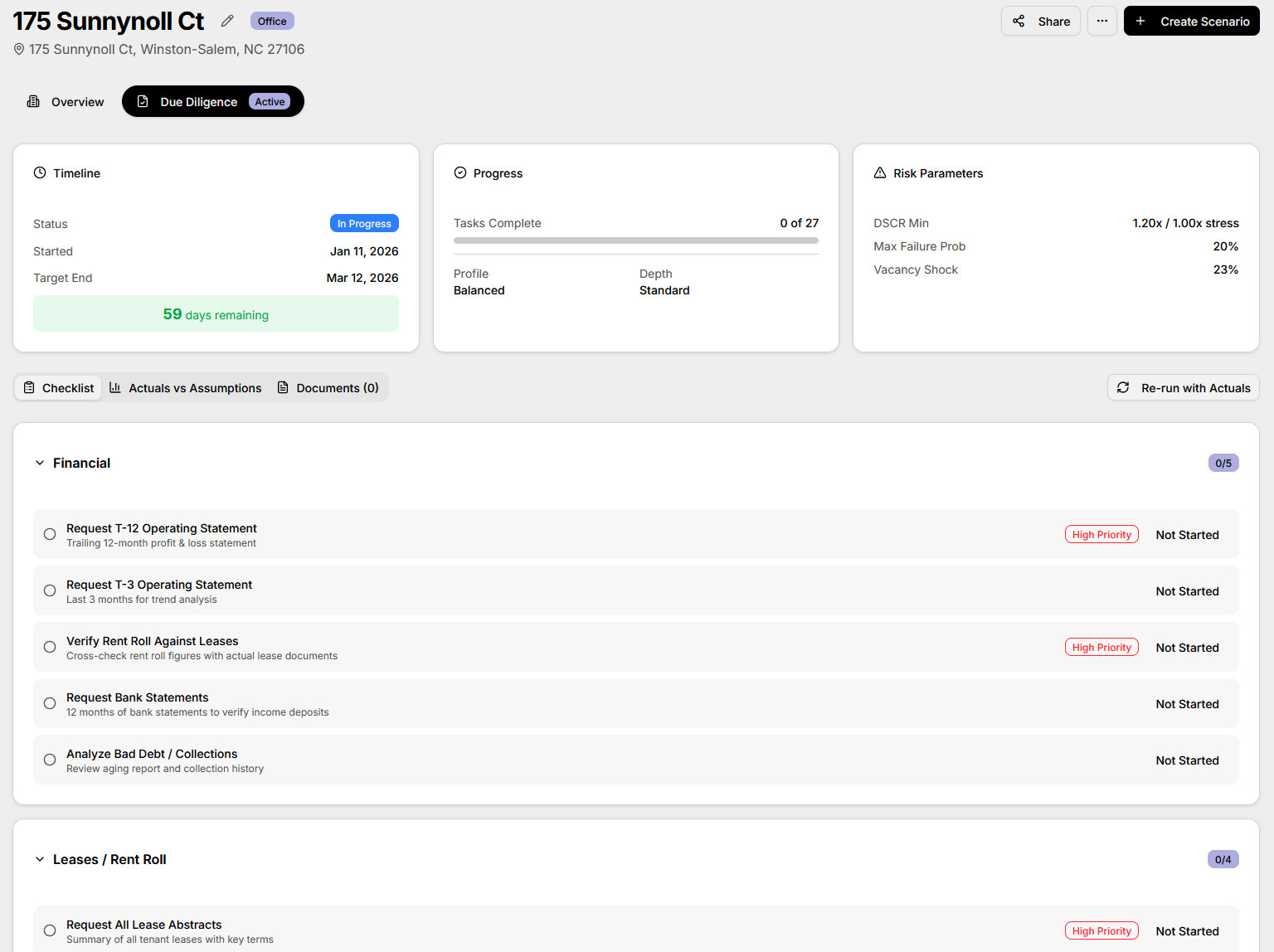

See how DealStrike helps you make smarter investment decisions

View real results on a real property

Not a demo. Not fake data. This is a live analysis you can explore right now.

Most apps hide behind signup walls. Click to view a complete analysis on an actual property.

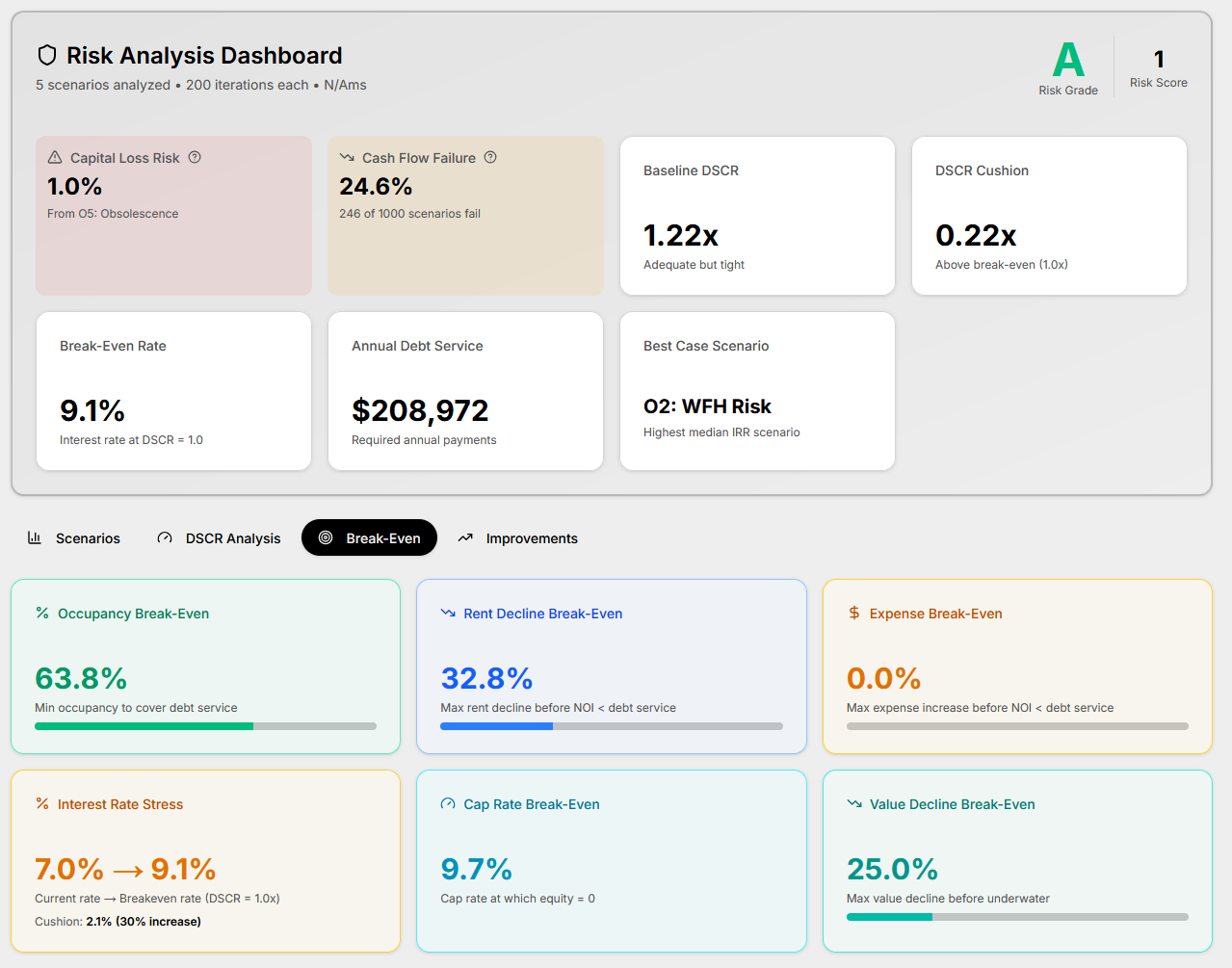

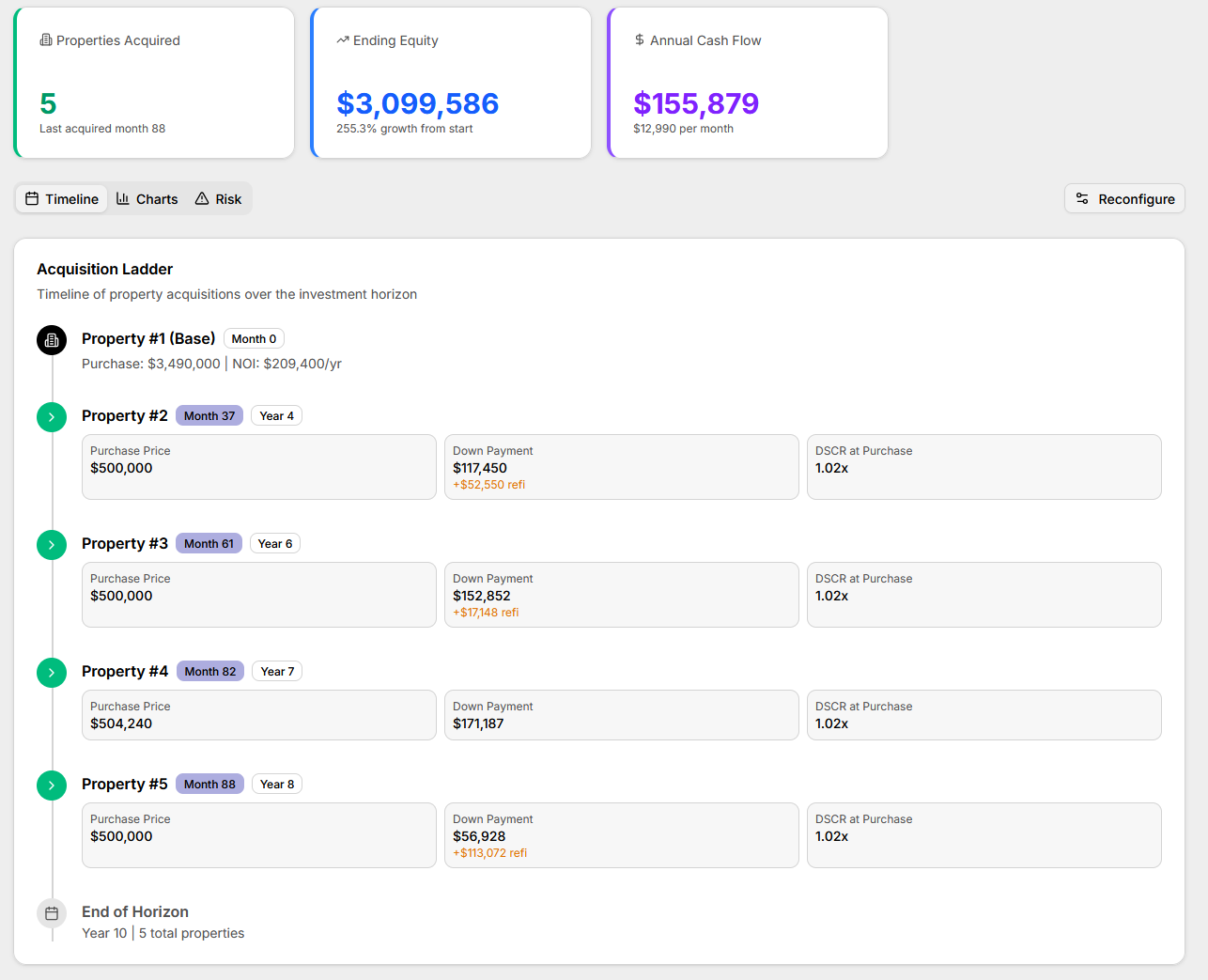

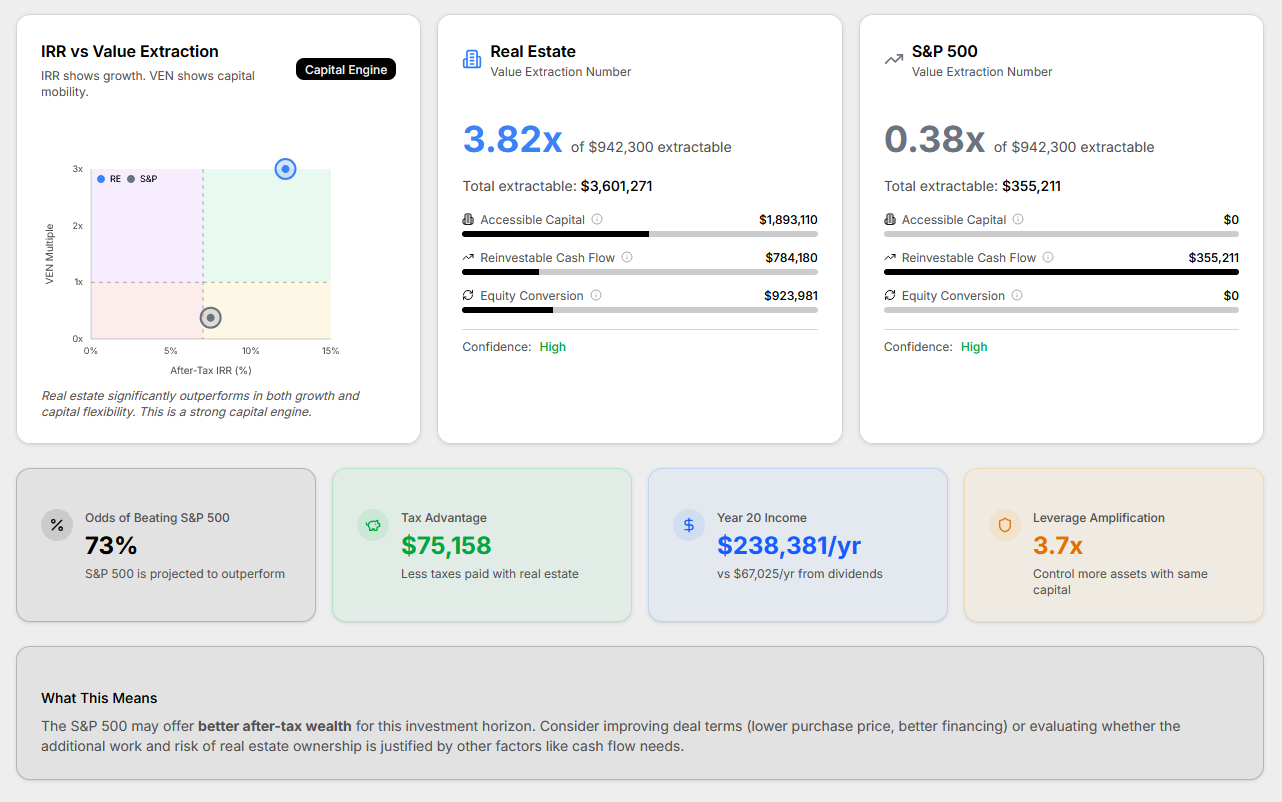

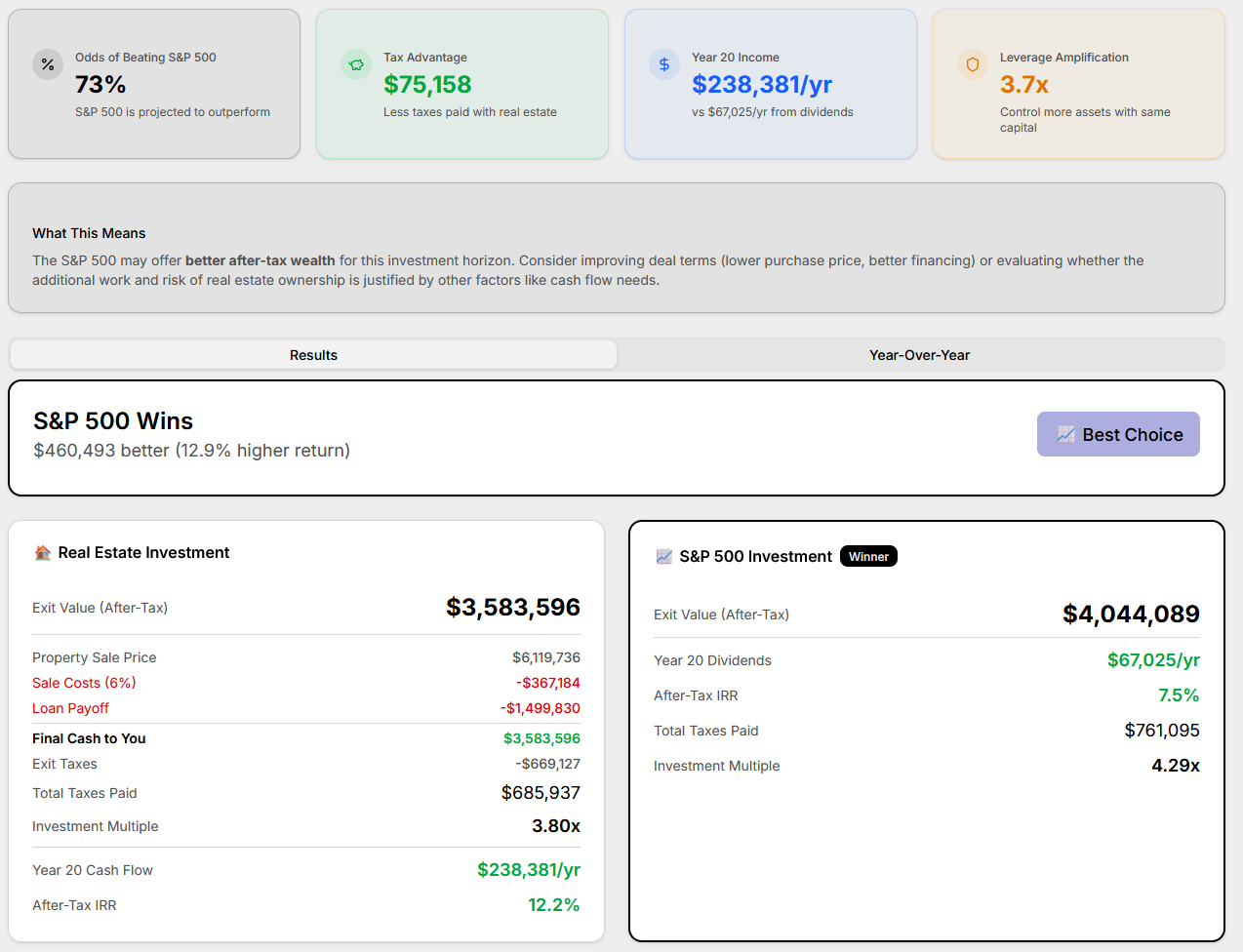

What you're seeing: A complete risk analysis comparing this real estate investment against the S&P 500, including tax implications, cash flow projections, and survival probability across 1,000 simulated scenarios.

No signup required. See everything.

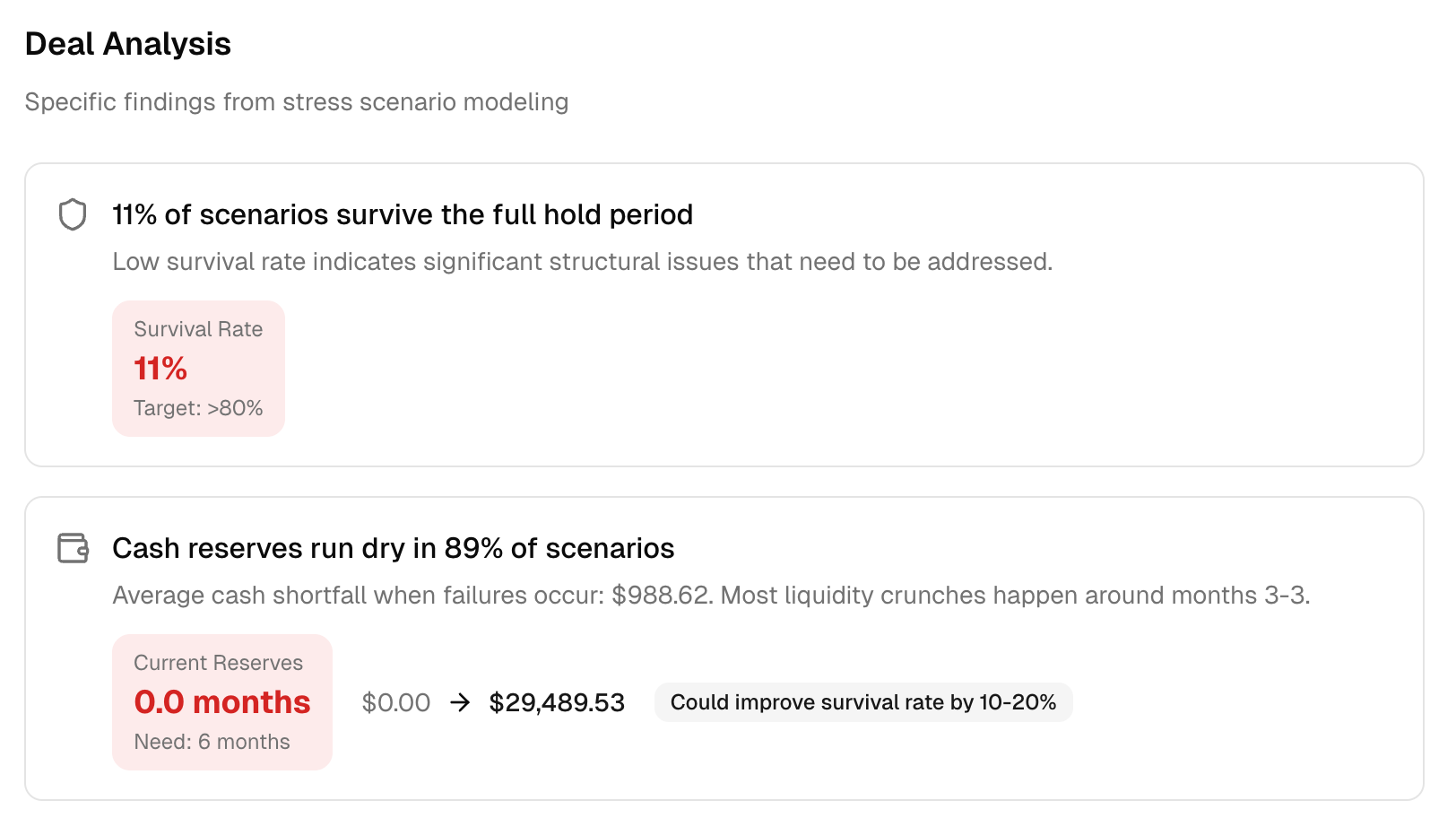

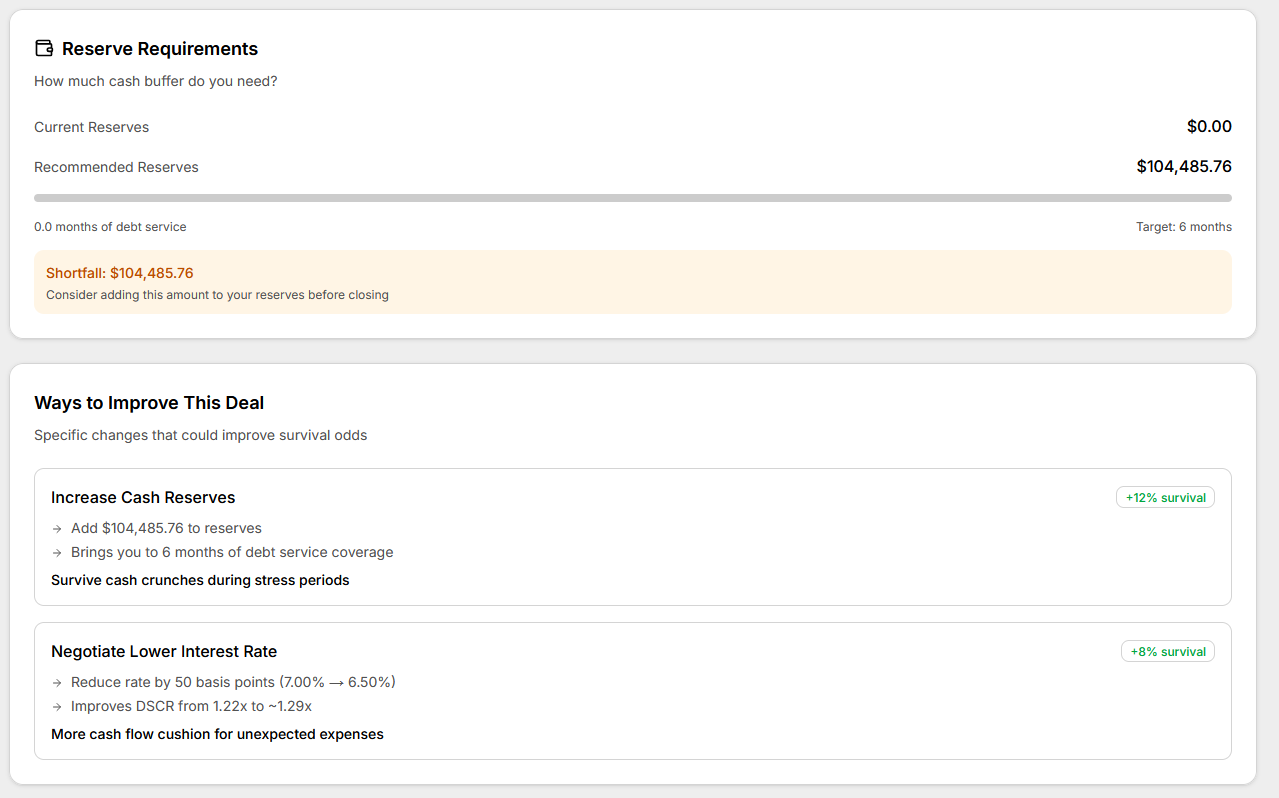

Find the failure before you buy

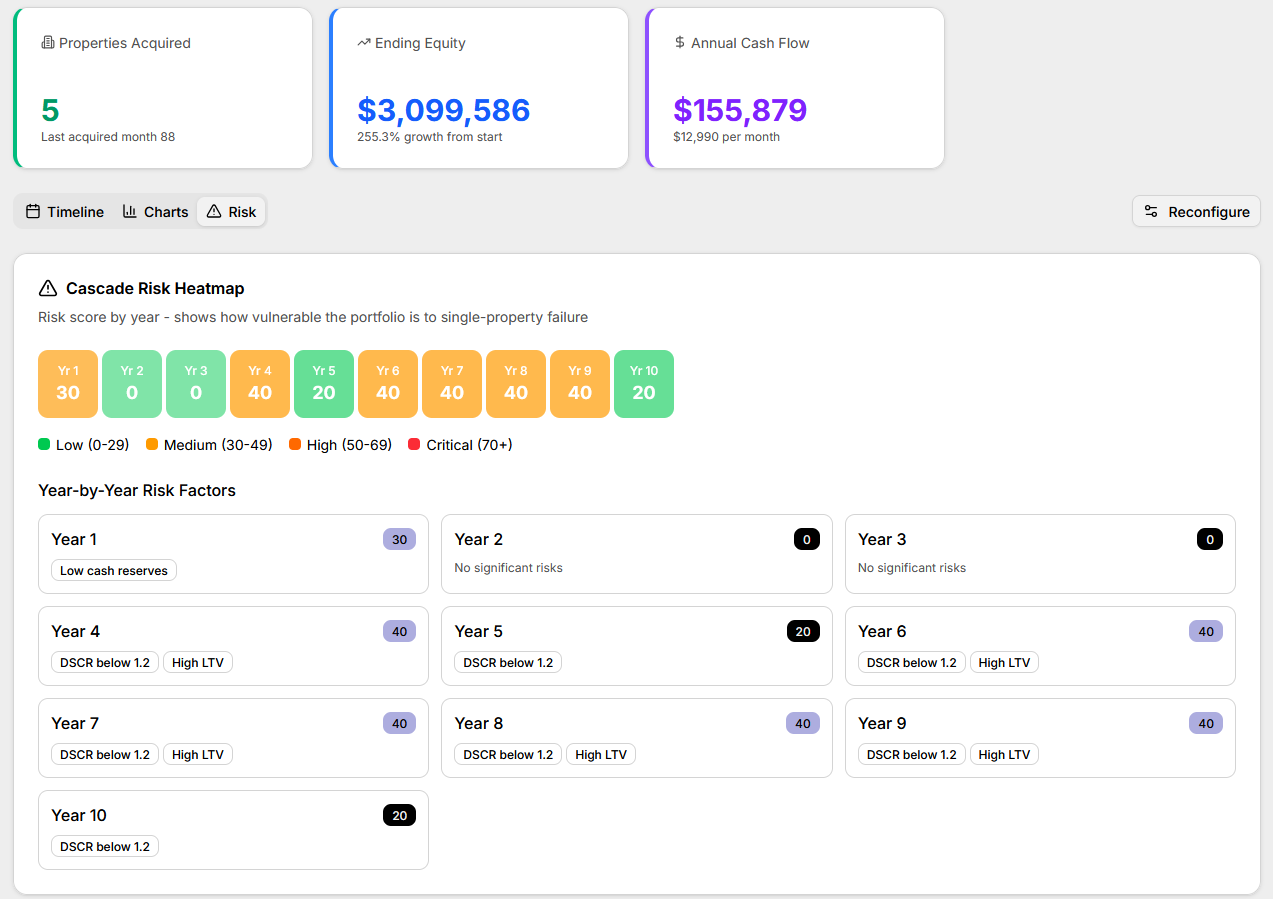

DealStrike stress-tests real estate deals against the things that actually go wrong; vacancy, rent declines, refinancing shocks, and expense creep - so you can see what breaks first and how bad it gets.

Spreadsheets show a single outcome. DealStrike shows how often that outcome doesn't happen.

Failure Analysis

See which scenarios break the deal — and how likely each one is to happen

What breaks first?

See which risk pushes the deal into trouble; cash flow, debt coverage, or refinancing and when it happens.

How bad can it get?

Understand downside paths, not just averages. See worst-case years and recovery timelines.

Is it worth it at all?

Compare the deal's cash flow and wealth outcomes against doing nothing or investing elsewhere.

Built for individual property owners and small operators making high-consequence buy decisions.

Created by a security engineer who specializes in failure analysis of high-risk systems.

DealStrike doesn't tell you how much money you'll make.

It tells you whether the deal survives when conditions change.