How DealStrike Works

DealStrike doesn't predict returns. It measures survivability. See how your deal holds up when reality hits.

A committee of agents stress-tests your deal

A committee of automated agents stress-tests assumptions, paths, and failure modes using an innovative risk framework and modeling approach. They're aware of your market, property type, and tweak scenarios and likelihoods to suit.

The team gives you faster clarity on risk, resilience, and opportunity cost.

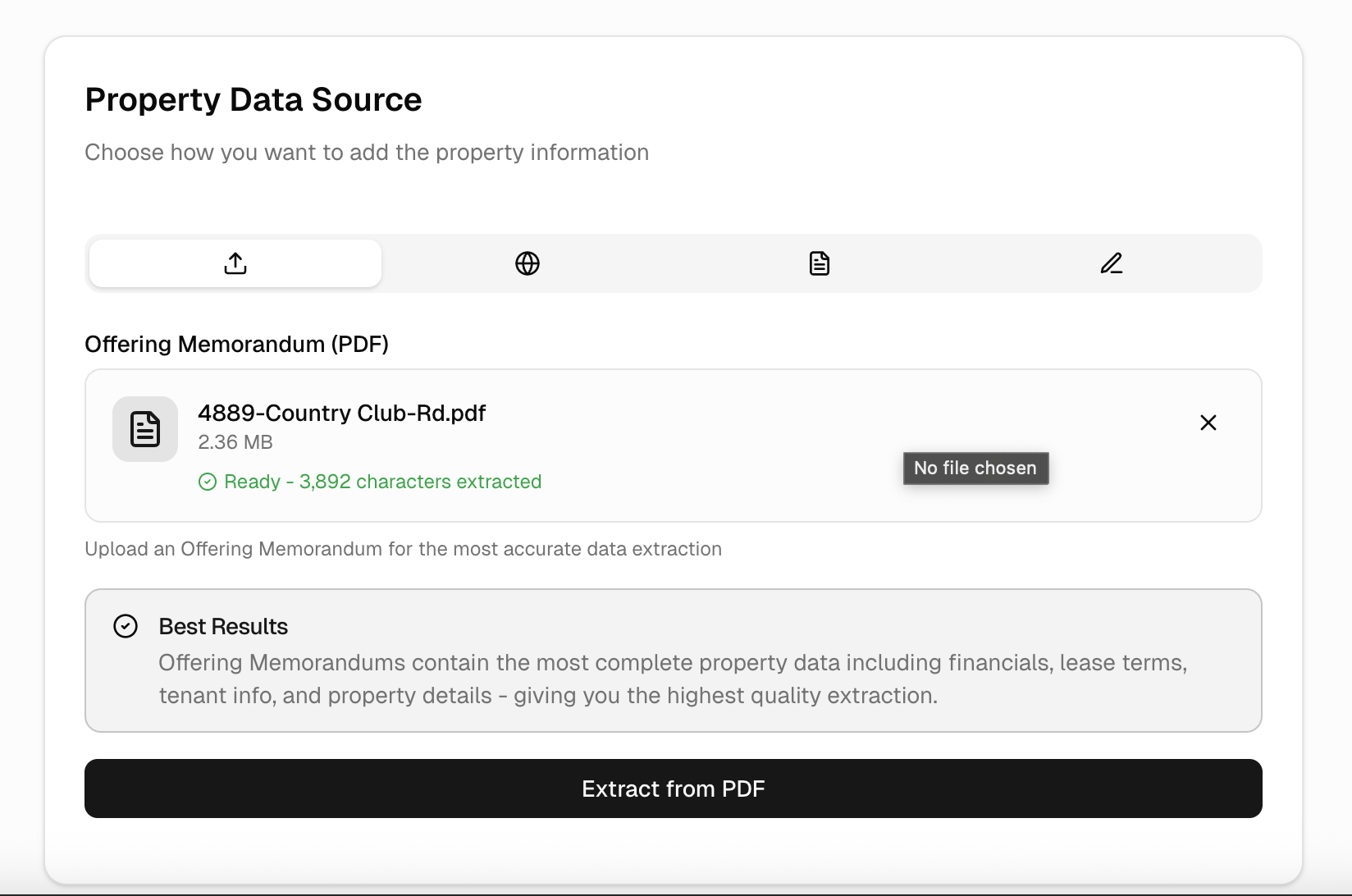

Start with your deal, not a blank model

Upload a listing, CoStar export, paste the Offering Memorandum, or enter your own assumptions. DealStrike starts with your numbers, not generic averages.

You define:

- Purchase price & loan terms

- Rent, occupancy, and expenses

- Hold period and exit assumptions

No forced templates. No black boxes.

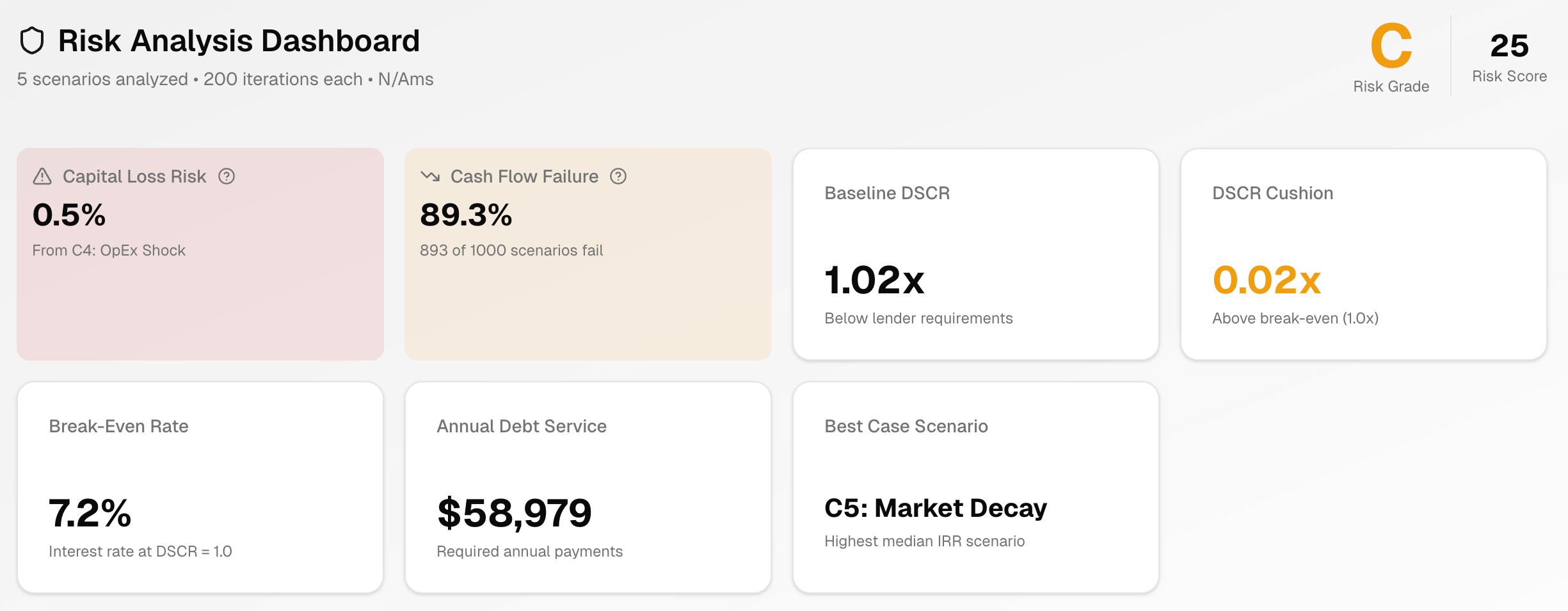

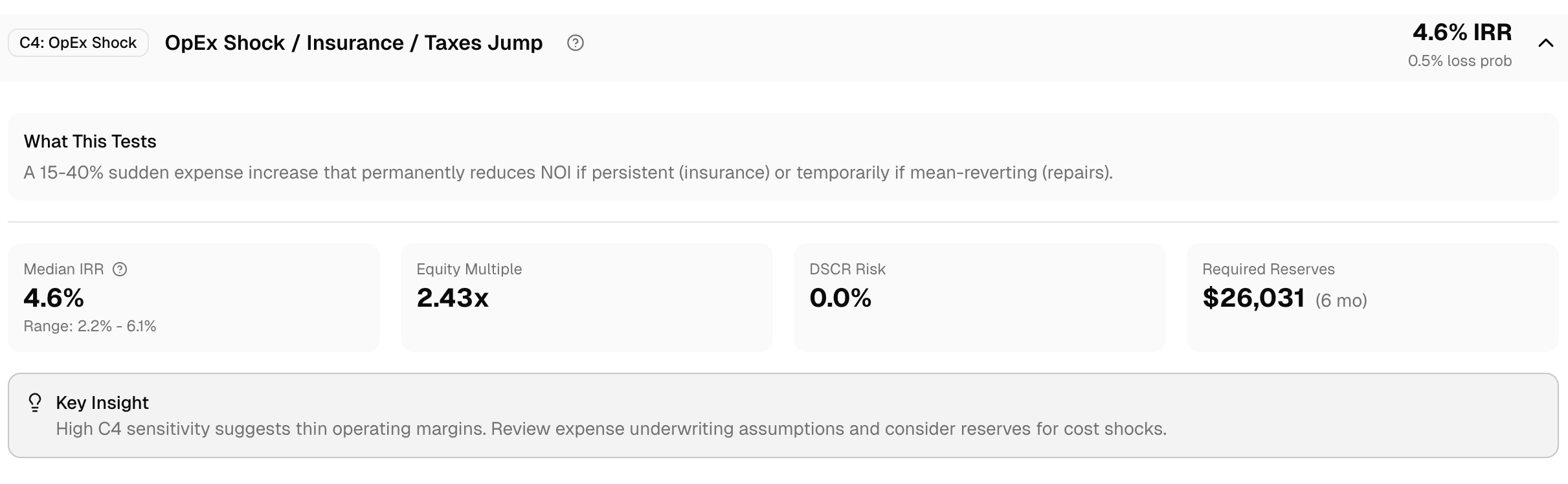

Explore how the deal actually fails

Instead of showing a single "expected" outcome, DealStrike evaluates 1000s of realistic downside paths and asks one core question:

Does the deal survive the full hold period?

You see:

- What % of scenarios survive

- What causes failure most often

- When failures tend to occur

This is where most spreadsheet models stop and where real risk lives.

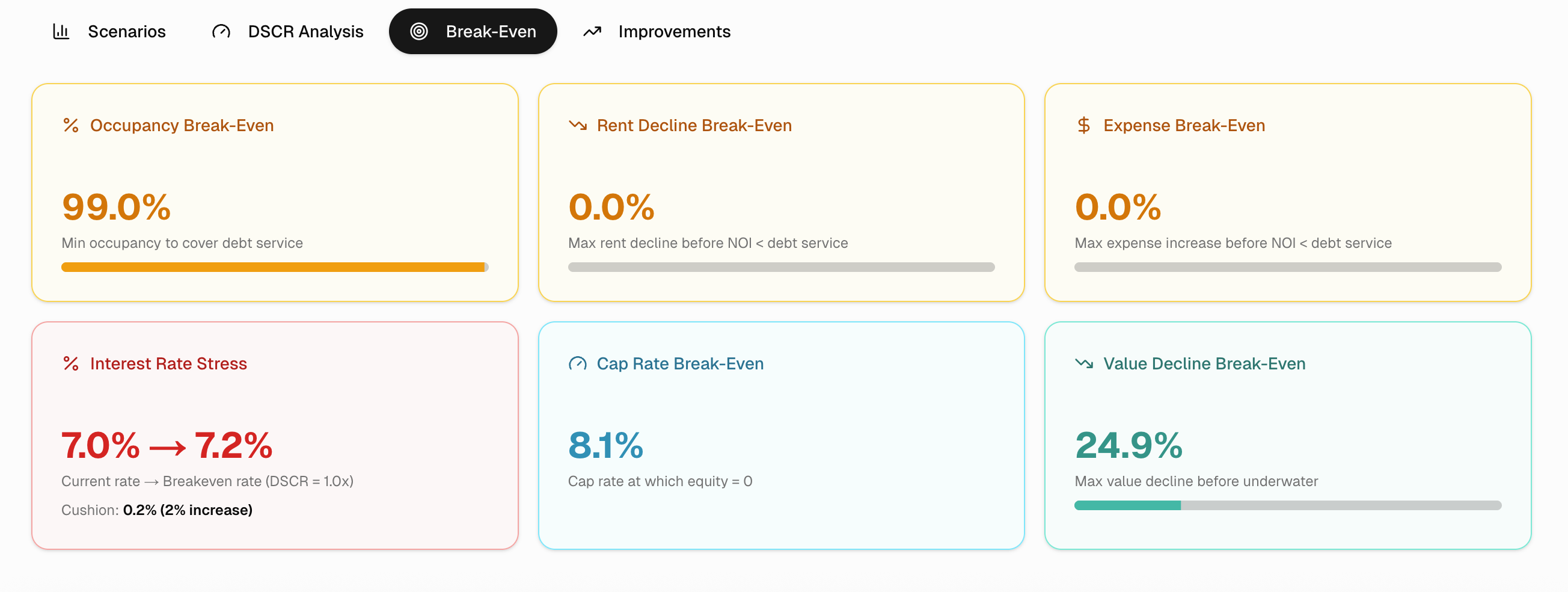

Stress the thin points, not just the averages

Break-even isn't safety.

DealStrike shows how little it takes for the deal to tip:

Occupancy required to cover debt

Rent or expense changes that break cash flow

Rate increases that push DSCR below 1.0

Value decline before equity disappears

You don't just see if it works you see how fragile it is.

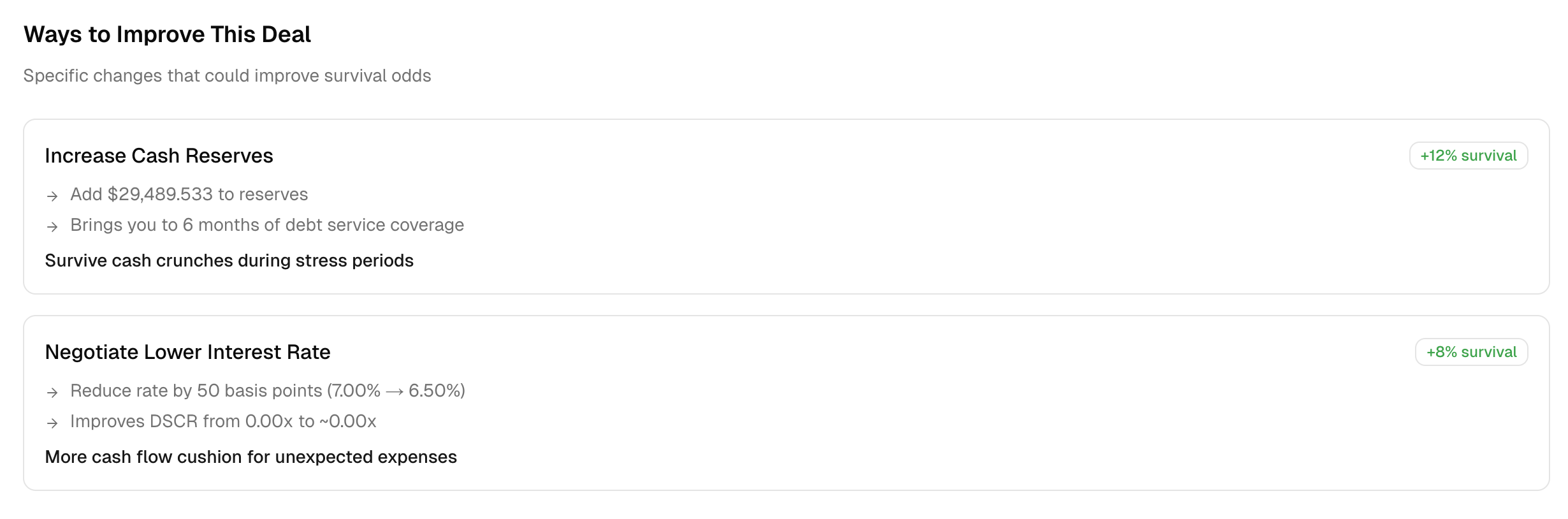

Identify what actually improves survival

Not all changes help. DealStrike tests potential improvements and shows which ones meaningfully increase survival odds.

Tested improvements include:

- Adding cash reserves

- Adjusting leverage or interest rate

- Changing pricing or exit assumptions

Each recommendation shows the expected lift in survivability, so you know where to focus and what's just noise.

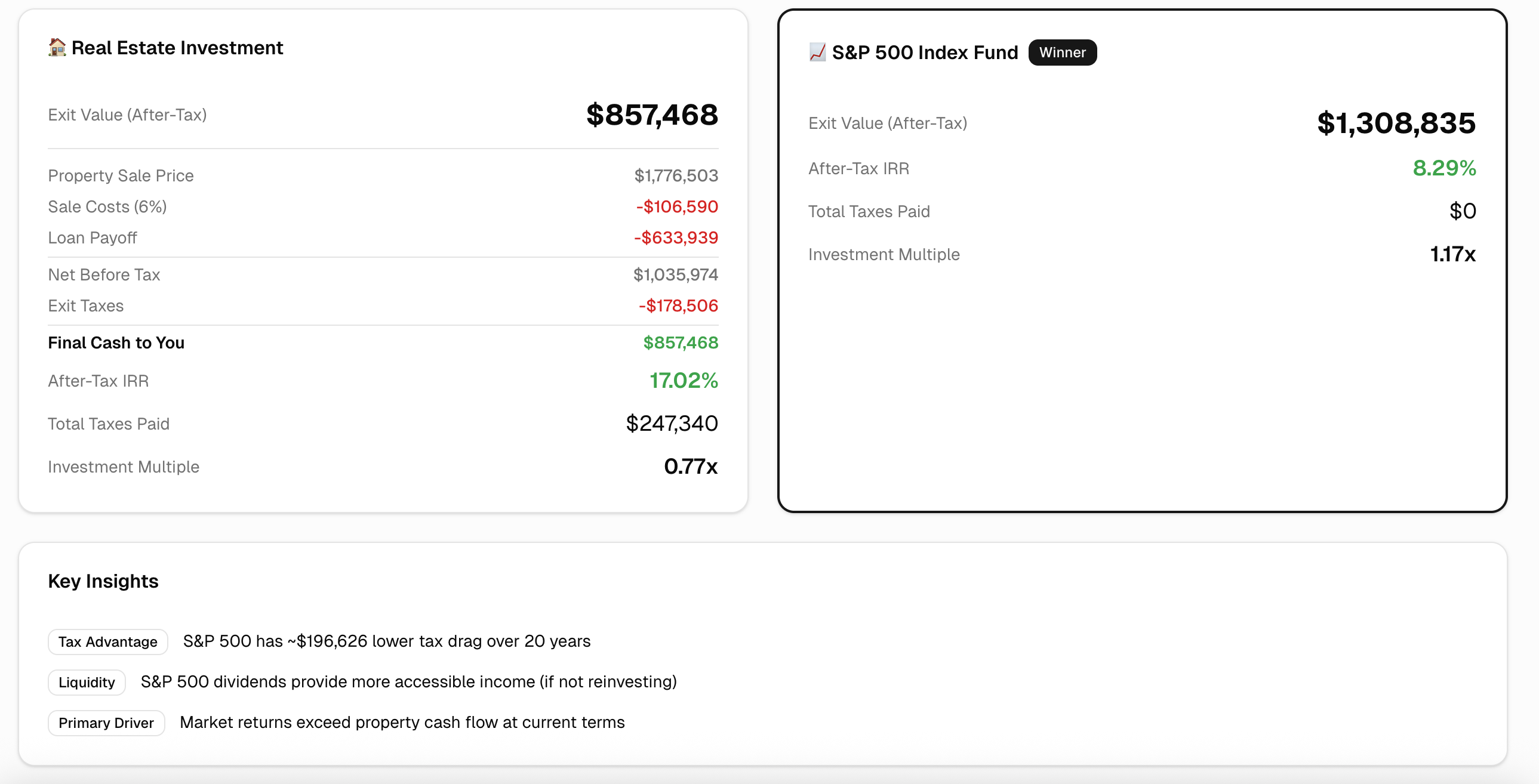

Compare risk against real alternatives

Finally, DealStrike puts the deal in context.

You can compare the opportunity cost:

- Cash flow vs liquidity

- After-tax outcomes

- Risk taken vs reward earned

This isn't about predicting markets it's about deciding whether this risk is worth taking at all.

View real results on a real property

Not a demo. Not fake data. This is a live analysis you can explore right now.

Most apps hide behind signup walls. Click to view a complete analysis on an actual property.

What you're seeing: A complete risk analysis comparing this real estate investment against the S&P 500, including tax implications, cash flow projections, and survival probability across 1,000 simulated scenarios.

No signup required. See everything.

Plus all the tools you'd expect

DealStrike isn't just about stress testing. It's a complete deal analysis platform with financial projections, collaboration tools, and everything else you need.

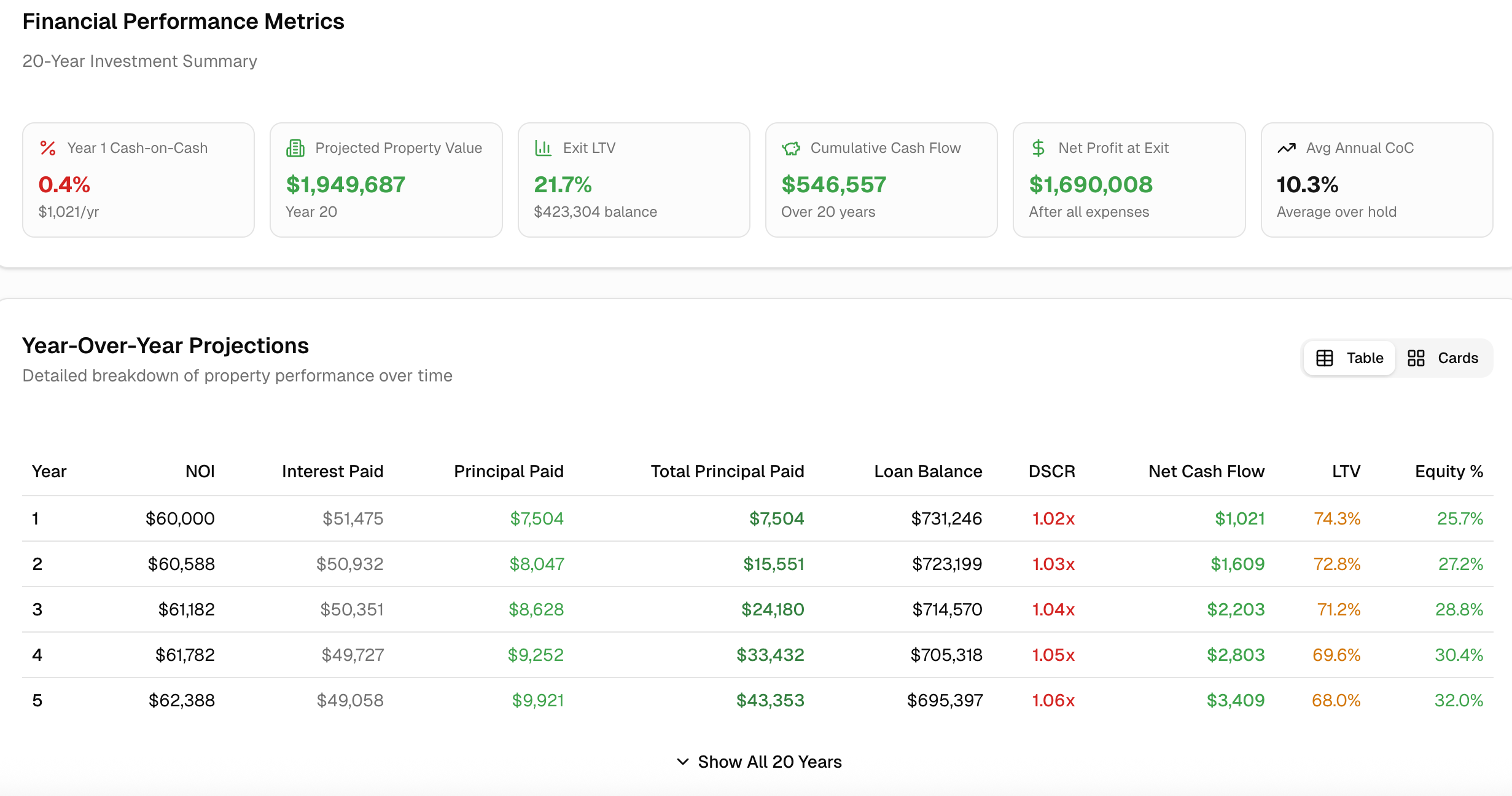

Financial Projections

Year-over-year projections with NOI growth, debt paydown, cash flow, and equity build-up. See your full investment timeline at a glance.

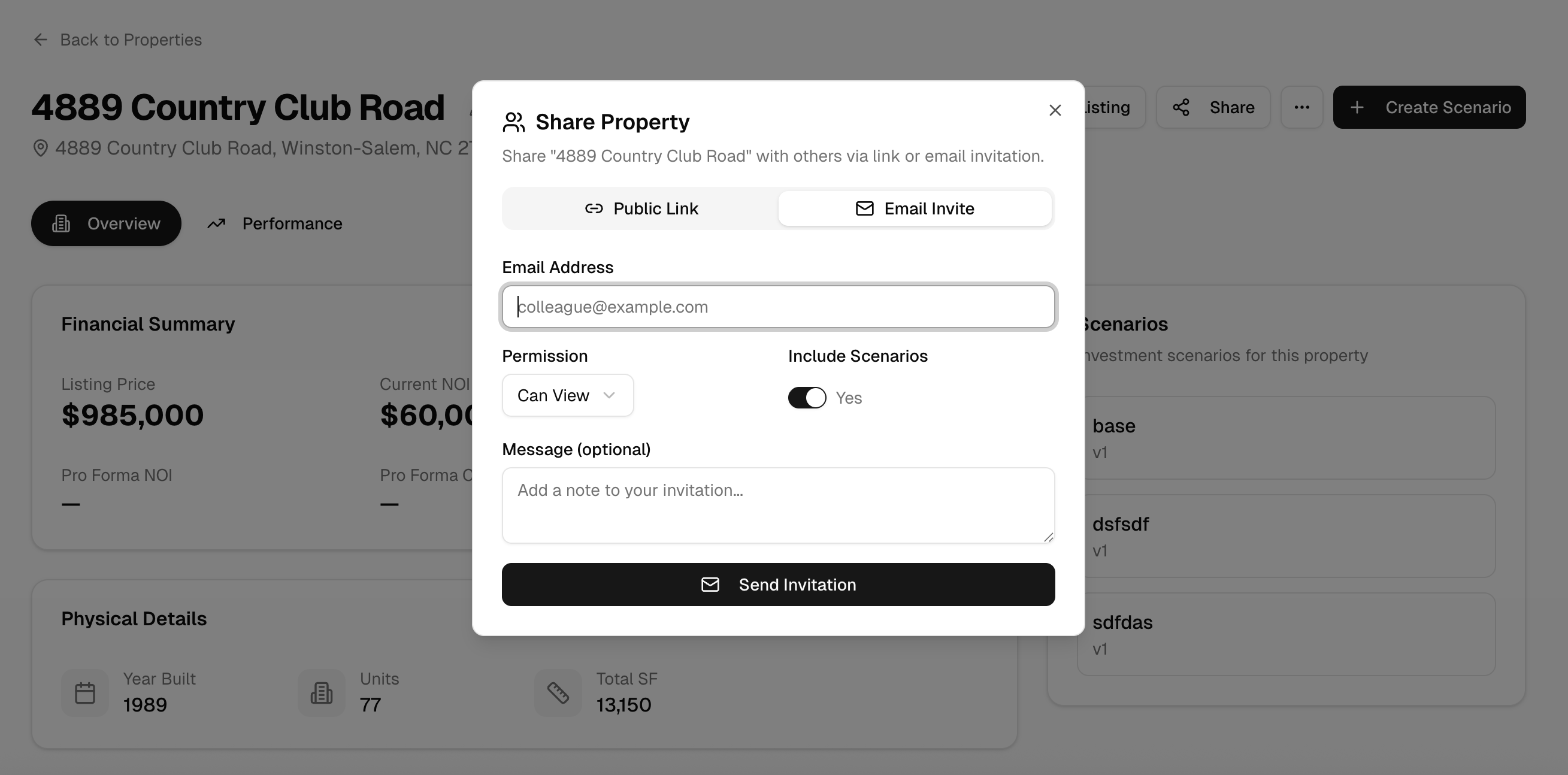

Share & Collaborate

Share deals with partners, lenders, or your team. Control permissions, include or exclude scenarios, and keep everyone on the same page.

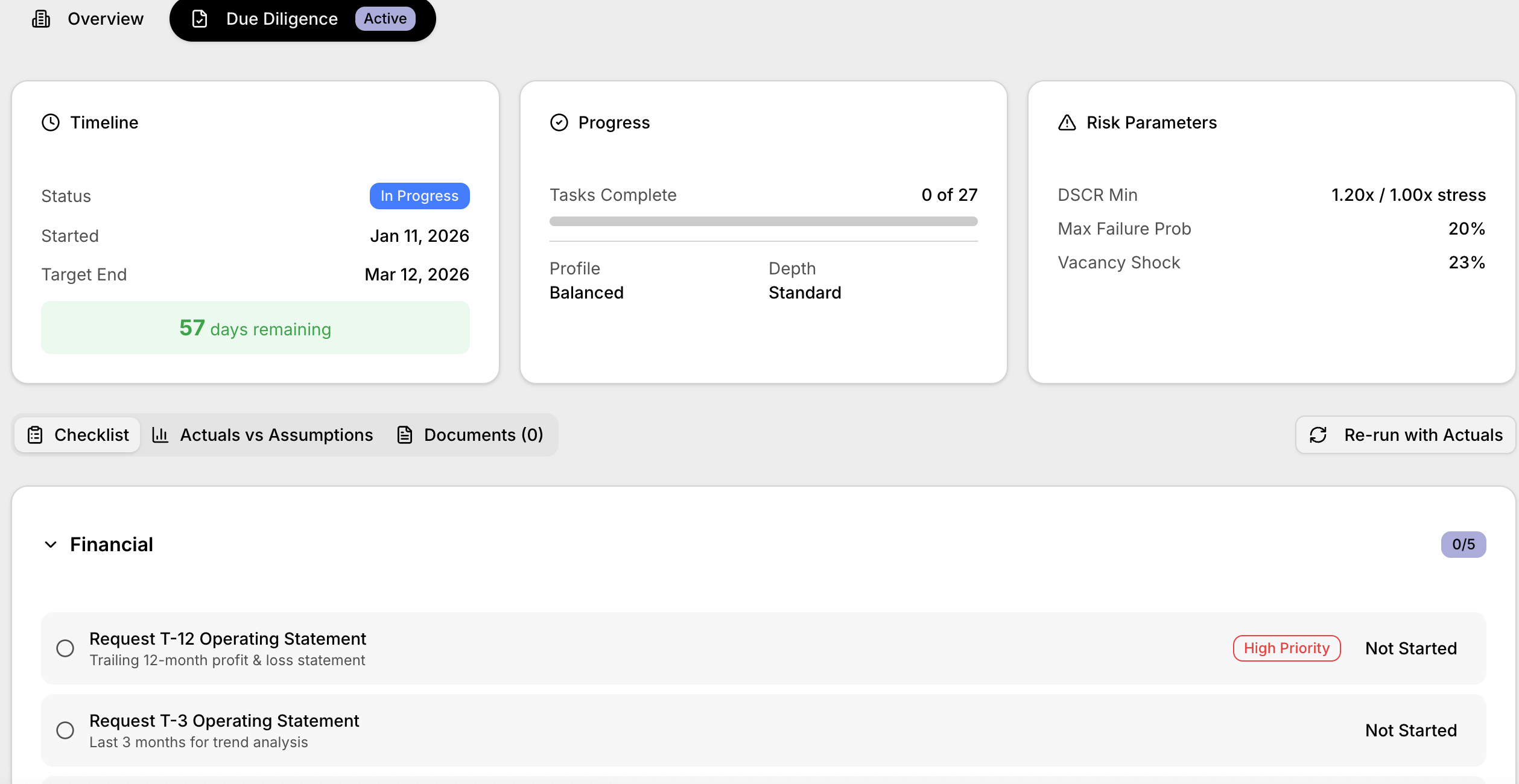

Generate LOIs, Manage Due Diligence

Upload your DD docs, we'll automatically update trackers and model your risks against new information.

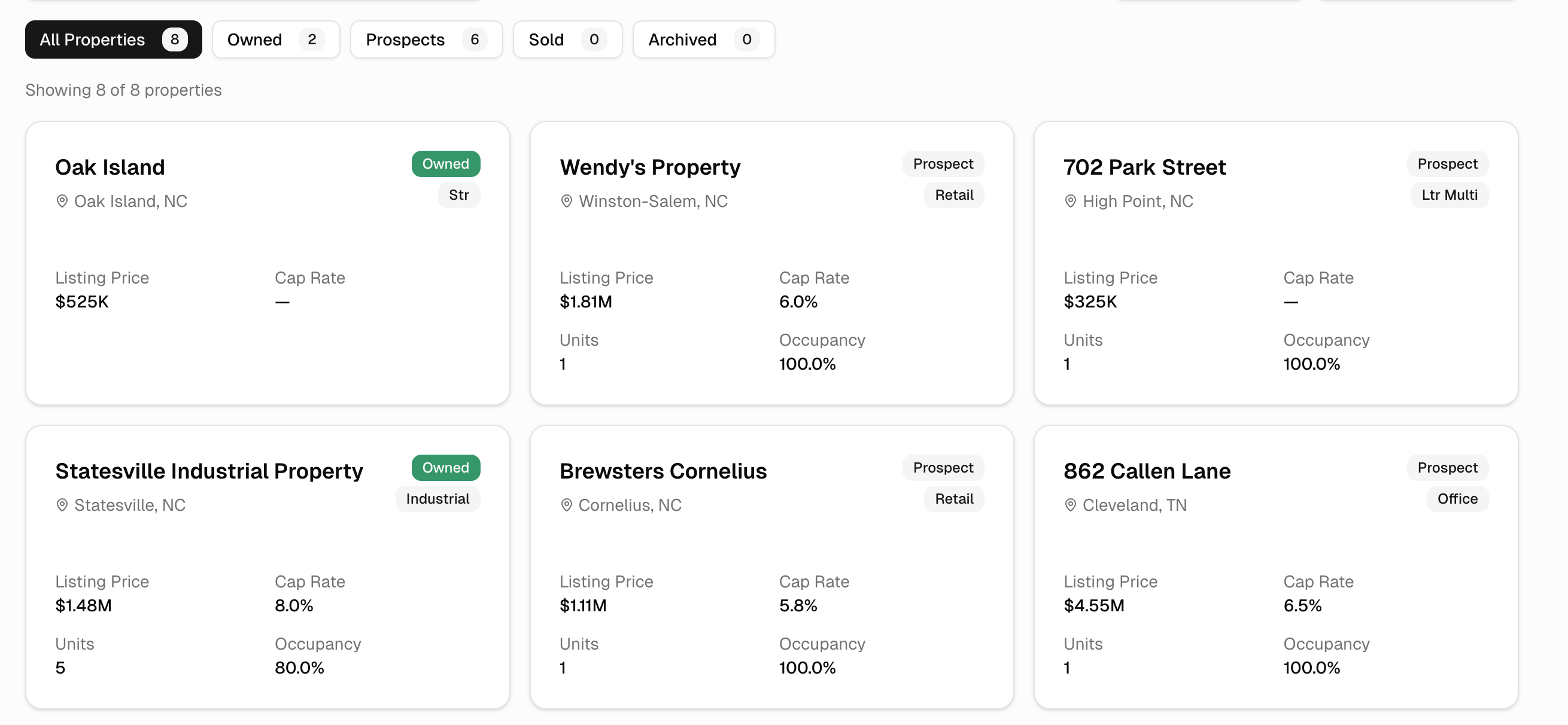

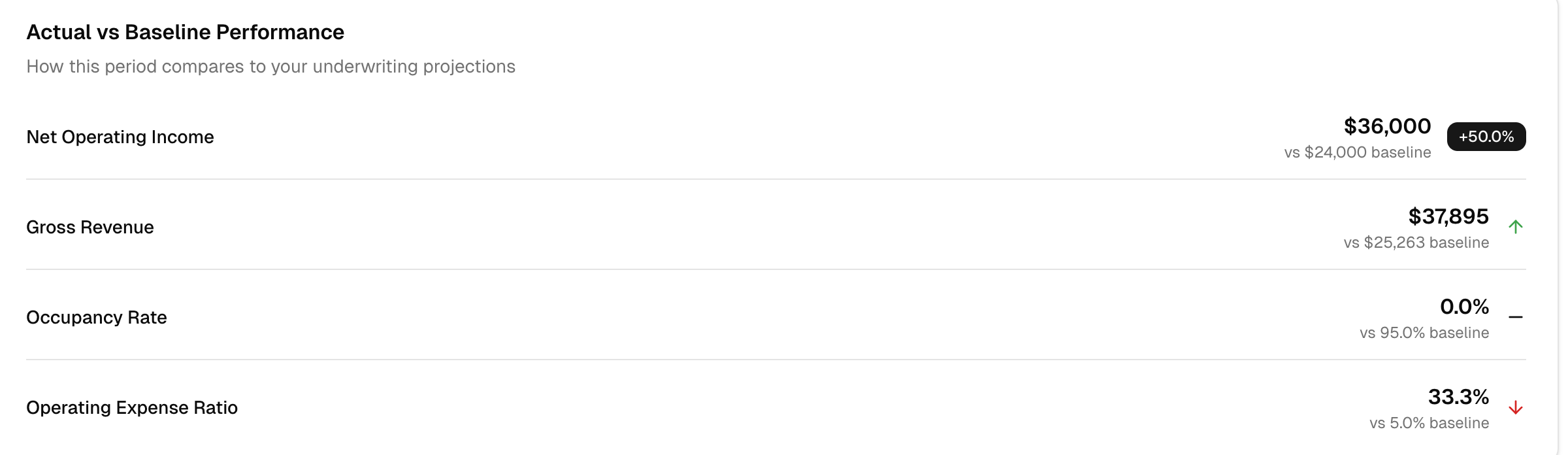

Portfolio Management & Tracking

Organize properties as prospects, owned, sold, or archived. For owned properties, track actual performance against your original underwriting assumptions to see how reality compares to your projections.

What DealStrike is (and isn't)

DealStrike doesn't predict returns.

It measures survivability.

It won't tell you how much money you'll make in the best case.

It tells you how often things go wrong and whether you can withstand them.

What this replaces — and what it doesn't

Single-scenario spreadsheets that show only one possible future

Broker advice, third-party underwriting, and market expertise

Judgment, experience, or due diligence — this is a tool, not a decision-maker