About DealStrike

I didn't come to real estate from finance. I came from breaking systems.

For the last 17 years, my work has been focused on a single question: what fails first when conditions change?

I've spent my career as a security engineer and adversarial engineer, in other words, a hacker. - My job is to assume things will go wrong, to stress systems in ways their designers didn't expect, and to measure not just if something can fail, but how often it does and what it takes to survive it.

That mindset is what led to DealStrike.

Adrian

Founder

Why I built DealStrike

Most real estate analysis spreadsheets assume a clean, linear future: stable tenants, predictable rents, smooth refinancing, and "reasonable" exit conditions.

In the real world, that's not how risk shows up.

Failures cluster. Cash runs out early. Small shocks compound. And most deals don't fail because they were obviously bad they fail because their margin for error was thinner than anyone realized. Spreadsheets are slow and error prone too.

DealStrike exists to model that reality.

Not to predict returns. Not to optimize upside.

But to answer the harder question: Does this deal survive when things don't go as planned?

Why an adversarial approach matters

In cybersecurity, we don't ask: "Does this system work in normal conditions?"

We ask: "How does it fail under pressure and how often?"

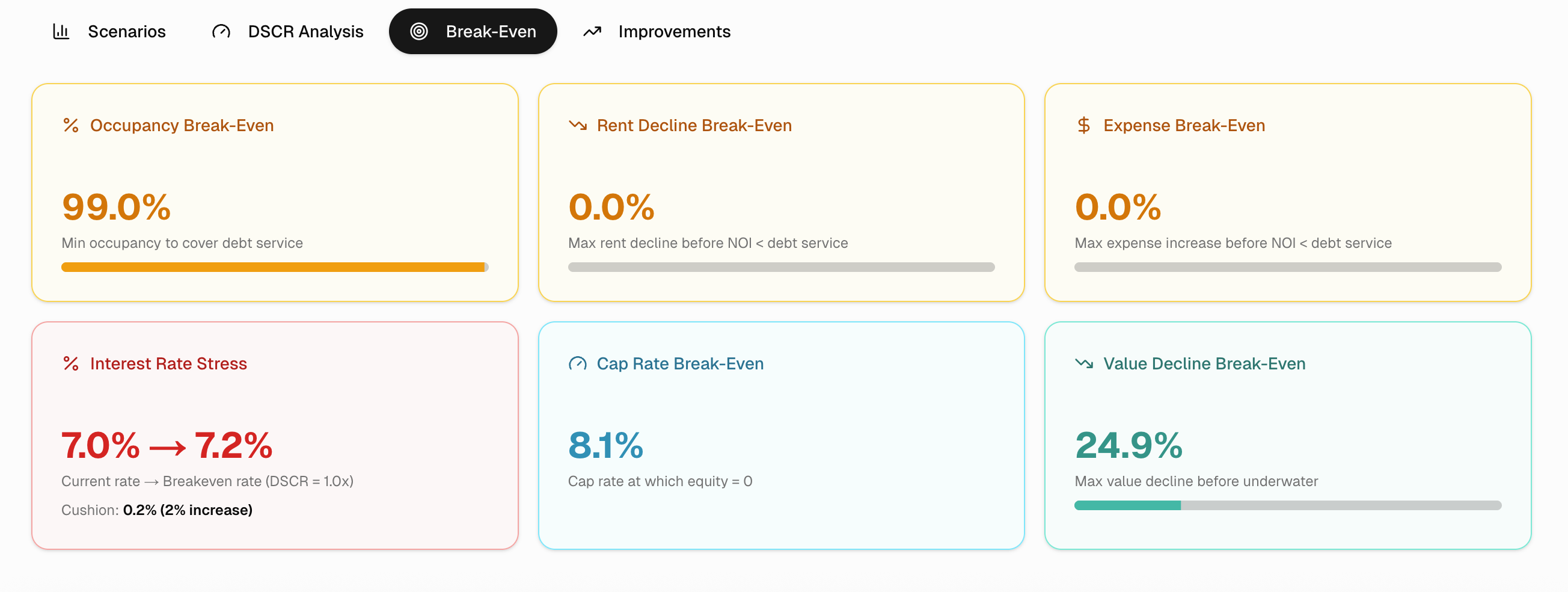

That same thinking applies to real estate. A spreadsheet can show you a single outcome. DealStrike explores the uncomfortable ones.

Cash Flow Breaks

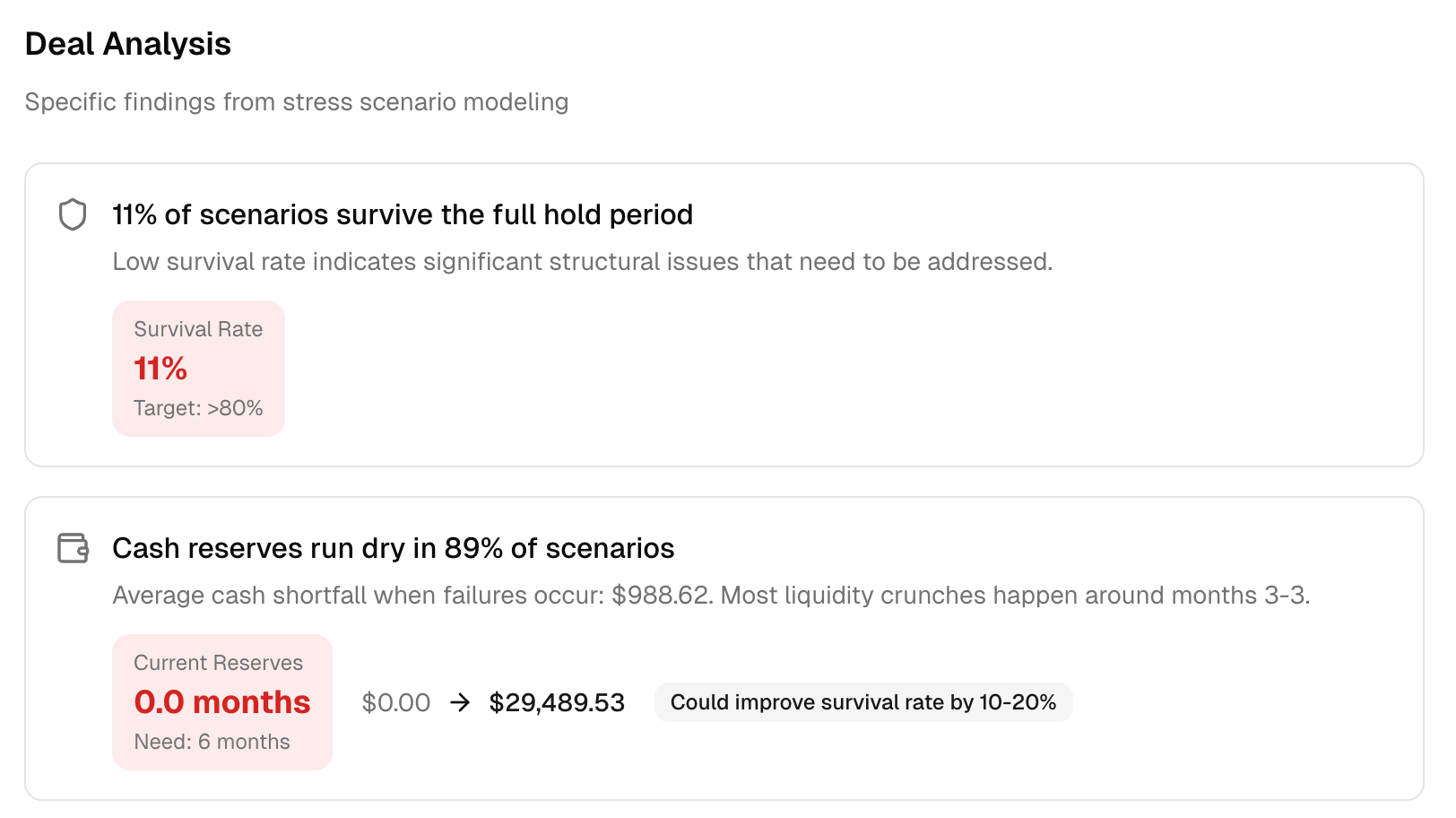

See how frequently cash flow breaks down across hundreds of stress scenarios.

Root Causes

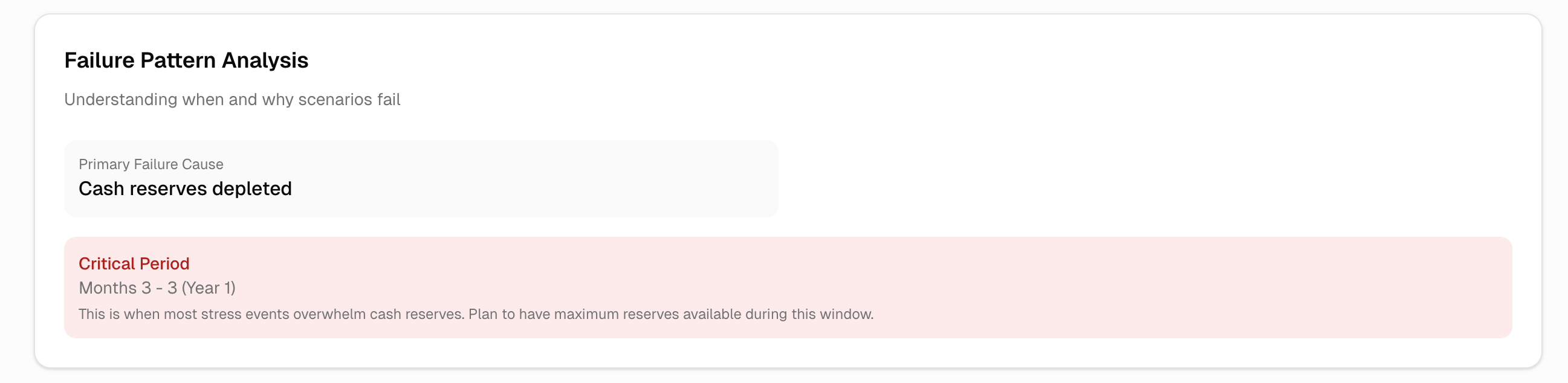

Identify what actually causes failure, not just that it happened, but why.

Critical Timing

Understand when the damage happens so you can prepare reserves accordingly.

Survival Improvements

Find which changes meaningfully improve survival odds before you buy.

This isn't theory. It's how high-consequence systems are evaluated when failure is expensive.

What DealStrike does differently

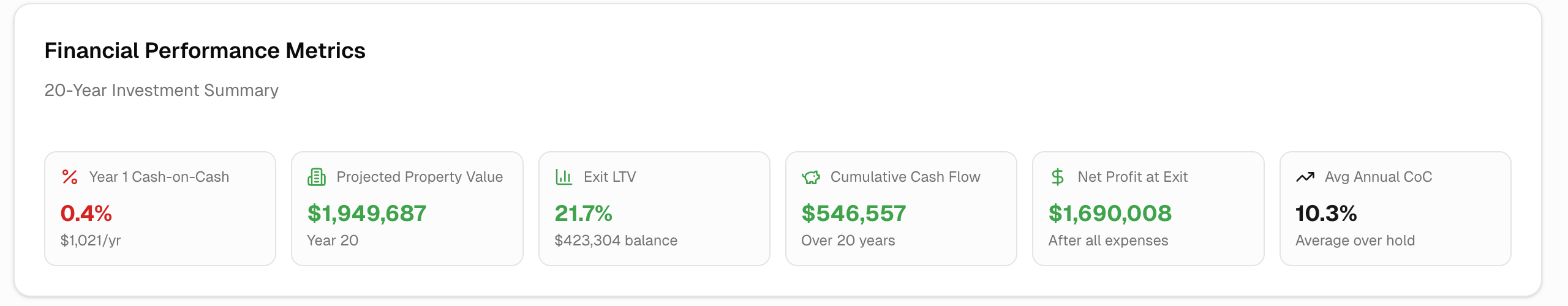

1. Survivability, not IRR

Most tools optimize for return. DealStrike asks whether you'll still be standing when markets shift.

2. Scenario clusters

We don't test one bad case, we test realistic combinations of stress to show how often you fail.

3. Built for clarity

You get clear metrics: survival rate, failure causes, cash break timing, and what would improve it.

What DealStrike is (and isn't)

DealStrike is not a replacement for experience.

It's not investment advice. And it won't tell you what to buy.

It's a risk lens built for people who want to understand downside before committing capital.

If you're looking for reassurance, this probably isn't the tool for you.

If you're looking to expose blind spots before they cost you, welcome. You're thinking like an engineer and measuring like a quant now.

I built this tool for my own decisions first. Then made it available to others who think the same way.